Mortgage without down payment - proven options for how to take in 2019 + TOP-5 banks that give a mortgage without a down payment

Good day, dear readers of the financial magazine "Rich Pro"! Today we continue the conversation about mortgage lending and let's talk about a mortgage without down payment: how can I get it in 2019 and which banks are ready to issue a mortgage loan without a down payment.

From this article you will learn:

- What is the down payment on the mortgage and where it goes;

- What are the features of mortgage loans with zero down payment;

- What methods exist for obtaining a mortgage in the absence of money for the initial payment;

- In which bank can I take a mortgage without down payment;

- Who will help in obtaining a home loan?

At the end of the publication you will find answers about the mortgage without down payment, which arise for most applicants for such a loan.

The article will be interesting to everyone who is interested in mortgage lending. We recommend that you pay special attention to the publication presented to those who want to apply for a loan to purchase their own housing, but do not have a sufficient amount to make an initial payment.

As they say, time is money! Therefore, do not waste a minute, start reading now!

How to get a mortgage without down payment: what are the most popular methods and in which bank you can get a mortgage without a down payment - read in this issue

How to get a mortgage without down payment: what are the most popular methods and in which bank you can get a mortgage without a down payment - read in this issue

1. What is a down payment on a mortgage and why is it needed 🏠

Down payment when applying for a mortgage, they name a part of the cost of the acquired property that must be available to the borrower in order to obtain a loan from the bank.

Depending on the chosen mortgage program, the down payment may be absent altogether, or it may reach 90% of the price of the purchased property.

Traditionally, sources of down payment may be:

- cash accumulation;

- consumer credit;

- available property to be sold.

Borrowers should keep in mind that if there is a down payment in excess of 70% of the cost of the purchased apartment, a mortgage replacement scheme may be beneficial consumer credit.

This approach will not only greatly simplify the process of obtaining a loan, but also reduce the level of necessary costs. This is because in consumer lending are absentcommissions and insurance paymentsinherent in a mortgage.

However, the scheme described above is not suitable for everyone, because usually the decision on obtaining a mortgage is made by citizens who have a much lower amount as an initial contribution.

Today, banks allow you to issue a mortgage with a very small contribution, and even in its complete absence.

But it is worth keeping in mind that when calculating the possible loan amount, the bank takes into account the cost of the apartment, which will be established during the analysis of the property appraiser.

If the seller has set the cost of the apartment above the estimated, then the minimum down payment is unlikely to succeed. The bank will calculate the maximum possible loan amount based on the estimated value.

The difference between the size of the mortgage obtained in the course of the calculations and the market price of the apartment in full falls on the shoulders of the borrower and must be made as an initial contribution. Payments can be calculated through our mortgage calculator.

2. Features of a mortgage without a down payment 🗒

A mortgage for which there is no down payment is risky for both the credit institution and the borrower.

Before 2008 of the year Mortgage programs that do not require savings were widely distributed throughout Russia. At that time, real estate prices grew much faster than they managed to accumulate an amount sufficient for the down payment.

However busted economic crisis led to the fact that many banks had to abandon mortgage lending programs without a down payment. Moreover, this happened even in spite of higher rates for such programs.

However, when registering a mortgage without a down payment, the risks are high not only of the credit institution, but also of the borrower.

If solvency debtor for any reason will decrease, after the sale of the apartment, he probably will not get absolutely nothing. This is due to the fact that in the early years, most of the payment goes to pay off interest. The amount of debt remains unchanged.

If the cost of an apartment decreases from the moment of purchase, it is likely that the borrower will remain in debt to the bank even after the sale of the mortgage apartment.

Many borrowers believe that a mortgage for them is an ideal option, which will replace the rent by depositing funds for their own apartment.

In this case, the following circumstances should be considered:

- usually, monthly mortgage payments are significantly higher than rentals;

- at least minimal savings may be required for the period when it is already necessary to pay for the mortgage, but you still cannot refuse to rent (eg, the apartment has not yet been issued, repairs are underway and other reasons).

The state is making every effort to make the mortgage more affordable. Therefore, lending for the purchase of housing with a minimum down payment is actively developing.

Today AHML(Agency for Housing Mortgage Lending), whose units are open in most Russian regions, offers mortgage programs with a contribution 10%.

But it is worth keeping in mind that such conditions provide conclusion of additional insurance contracts. Naturally, this increases the amount of the final overpayment.

Most banks do not welcome a mortgage without a down payment, as the lack of savings can indicate a low income, as well as poorly organized financial discipline.

Experts advise future borrowers verify the reality of paying mortgages. Enough for this for a long period (not less than six months) set aside a planned amount of credit payment to a separate bank account.

If there are no problems with this, and the remaining funds will be enough to stay, you can safely arrange a mortgage. Moreover, the accumulated funds can be used as an initial fee or how financial stock in case of any problems.

Finding a mortgage program without a down payment can be difficult. Therefore, for those who do not have the means to pay it, there is another option for obtaining a mortgage - receive funds for a down payment through consumer credit. We have already talked about how to get a consumer loan in one of the previous articles.

In this case, it should be borne in mind that the rate on such a loan is much higher. But it will be possible to repay it in a much shorter time.

Those who choose this method of registration of a mortgage, worth keeping in mindthat in the first years the payment will be much higher, because you have to pay two credits at once. That is why you need to carefully evaluate your financial capabilities.

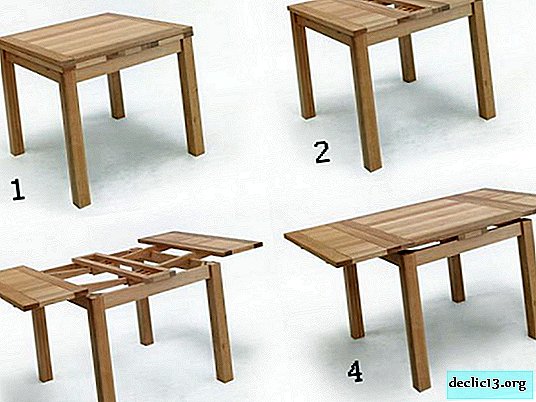

Popular mortgage options without down payment

Popular mortgage options without down payment

3. How to get a mortgage without down payment - TOP-7 design options

The economic crisis has led to a decrease in the popularity of mortgage lending in Russia and the countries of the former USSR. Statistics show a significant drop in mortgage demand over the previous two years almost on 20%.

Experts suggestthat in the absence of changes in the economic situation in Russia, the decline in mortgage lending will continue. In such conditions, credit organizations are forced to treat potential borrowers more loyally, as well as develop more attractive mortgage programs.

At the same time, banks cannot afford to lower the rate to the level 10% Under current inflation, this will lead to loss of mortgage lending.

In times of crisis, credit organizations do not welcome the issuance of mortgages without down payment. However, there are several ways that allow the borrower to obtain a mortgage loan, without having sufficient savings. About how to take a mortgage for an apartment or other housing, we wrote earlier.

The main ways to get a mortgage without down payment

The main ways to get a mortgage without down payment

Option 1. Preferential mortgage programs

For unprotected categories of citizens The state has developed several programs whose purpose is to help improve housing conditions. You can find out what programs operate today in the place of residence of the applicant in local authorities.

Most often, benefits are provided military personnel, young families, as well as young teachers. Mortgages for the first category differ in the implementation scheme, so we will consider it separately.

Use a social mortgage can citizens whose age does not exceed 35 years. To take part in the program, you need to contact the local authorities to confirm the need to improve housing conditions.

If the decision to participate in the project is positive, the applicant will be put on a waiting list housing certificate. After assistance is provided, there are several options for using it. The most popular is to send subsidized funds to pay the down payment.

Please note that usually the amount of subsidies does not exceed 10% of the cost of housing. Therefore, banks, developing mortgage programs with state support, establish down payments at this level.

There is one more important condition - limited duration of housing certificate. He makes up 6 months, it is during this time that you should choose a bank, find suitable housing and complete the deal.

It is important to keep in mind that only banks that are partners have the right to work with social mortgages. AHML.

Option 2. Military mortgage

This option is ideal for those who decide to apply for a mortgage, not having the funds to make a down payment. But this method is available exclusively to military personnel.

To get a military mortgage, you need to overcome several steps:

- Become a member of the funded mortgage system;

- Across 3 year from the date of registration in the program, apply to the Federal Service for Military Education;

- When obtaining a mortgage permit in the previous step, find a bank working with military mortgages;

- Choose a suitable residential property that can be located in any region of the country;

- Sign the necessary documents and become the owner of the apartment or house.

The advantage of a military mortgage is that for program participants Ministry of Defense of the Russian Federation contributes not only an initial feebut also subsequent monthly payments.

But there are limitations:

- the right to a subsidy is subject to the faithful performance of official duties;

- the maximum amount of subsidies is 2,2 million rubles.

It should also be borne in mind that until the full repayment of the mortgage loan housing will be burdened double security - from the bank and the state.

This means that to dispose of the property at its discretion (eg, sell or give) a soldier will not succeed.

Option 3. Mortgage with maternity capital

Maternal capital is one way to get help from the state. The subsidy is given to families in which a second child has appeared.

Use of maternity capital as a down payment on a mortgage loan

Use of maternity capital as a down payment on a mortgage loan

One of the uses of subsidies is down payment when applying for a mortgage loan.

Today, the amount of maternal capital is 426 thousand rubles. On average, this amount allows you to cover about 20% of the cost of housing. Therefore, maternity capital is usually enough to pay the down payment.

An important circumstance is the fact that when applying for a mortgage, you can use maternity capital immediately after birth (unlike other use cases when you need to wait 3 of the year).

Before the subsidy is transferred to a credit institution, the applicant will need get permission from the Pension Fundwhich is issued before 2 months.

With this in mind, the action algorithm for the borrower will look like this:

- Search for a developer or owner of a finished apartmentwho agree to sell the property using parent capital;

- Obtaining permission from the Pension Fund on the use of maternity capital for the purchase of housing;

- Search for a credit institution and, accordingly, the choice of a mortgage programin which you can apply for a home loan using maternity capital as a first installment;

- Mortgage Application;

- In case of a positive decision, the signing of contracts, making a down payment with a state certificate, registration of housing as a property with imposition of an encumbrance.

By the way, those who already have a mortgage loan have the right to send maternity capital to repay the main debt under the contract.

Option 4. Marketing Promotions

Today, many banks are developing various ways to attract customers. mortgage stocks, including its design with zero down payment. Most often, such actions are carried out jointly with developers who seek to increase sales.

This option cannot be called reliable enough. You have to wait a long time when the action will be launched. In addition, the choice of real estate for such programs is traditionally limited.

Option 5. Mortgage secured by existing property

Another option for obtaining a mortgage in the absence of money for a down payment - use the property owned by them instead.

Most banks easily go for it, since such a scheme is beneficial for them. For borrowers, this option poses significant risks.

There are a number of conditions for real estate, which is planned to be pledged:

- possibility of use for living;

- high liquidity of the property;

- being in a bank-designated area.

It should be borne in mind that the amount of the loan secured by real estate usually does not exceed 70% of the real value of the property.

Option 6. Additional security

As an additional security, which will replace the down payment, it may be pledge of any values.

This can be not only real estate, but also the following assets:

- car;

- land plot;

- precious metals;

- securities.

As collateral, credit institutions usually accept highly liquid profitable investments. Banking experts are well versed in investing, so they are unlikely to agree to accept dubious assets.

Option 7. Getting a down payment through a consumer loan

The previous options are not available to everyone. Many citizens do not own expensive property, they are not entitled to state support.

In this case, some decide on consumer loan processing, which is subsequently sent to down payment. Sometimes credit organizations even offer special programs. In a separate article, we already wrote how and where to get a loan without refusal.

Experts recommend resorting to this option in the most extreme case. Do not forget that the burden on the family budget is significantly increase.

In this case, you first need to apply for a mortgage, and a consumer loan to issue only after her approval. We already talked about where to get a loan without refusal in the previous article.

Statistics show that most problems with paying mortgages are connected with the need to pay several loans at the same time.

Thus, even in the absence of funds for making a down payment, there is a chance to get a mortgage. It is important to explore all the possibilities and make the right choice.

Overview of banks where you can take a mortgage without down payment

Overview of banks where you can take a mortgage without down payment

4. Which banks give a mortgage without down payment - TOP-5 banks with the best conditions

In the struggle for customers, more and more banks are developing conditions for mortgage lending, providing for lack of down payment. However, not all programs can be considered beneficial for borrowers.

To understand which conditions are the most favorable, you will have to not only study, but also compare the programs of different banks. Naturally, the best interest can be found in the largest credit organizations in the country.

The table below shows the interest rates in the 5 best of them:

| № | Credit organization | Program | Rate (in% per annum) |

| 1. | Alfa Bank | Mortgage secured by residential real estate | 12,3 |

| 2. | Sberbank | Maternity Mortgages | 12,5 |

| 3. | VTB 24 | Military mortgage | 13,0 |

| 4. | Delta Credit | Consumer loan for a down payment on a mortgage | 15,0 |

| 5. | Zapsibkombank | Mortgage loan without down payment | 16,0 |

5. Help brokers in obtaining a mortgage loan without down payment

Finding the best mortgage program is not easy. The market today has a huge number of offers that should not only to analyze, but also compare.

The difficulty in choosing a mortgage program becomes even greater if the borrower does not have the funds to make a down payment, as well as the right to receive government subsidies.

To facilitate the search process, as well as save time for its implementation, help mortgage brokers. These are specialists who are well versed in all the intricacies of credit products operating in the market.

Naturally, brokers charge for their work commission. But taking into account the fact that they often achieve the most favorable conditions for the client, the borrower ultimately remains the winner.

In large cities, there are usually quite a lot brokerage companies. In small settlements, professionals most often operate on the basis of real estate agencies.

It is important to choose brokers with an impeccable reputation.

In the capital, the leaders in the market of mortgage brokerage services are:

1) Royal Finance

The employees of this broker have vast experience working in various credit organizations.

Therefore, they are well versed in all the intricacies of mortgages.

2) LK loan

Despite the fact that the company has recently been in the brokerage market, it has already managed to win the gratitude of a huge number of customers, as well as an impeccable reputation.

Here they do not require any prepayment, and all fees are charged exclusively in accordance with the contract.

3) Credit Laboratory

The company employees have vast experience gained over many years of fruitful work.

This helps prepare the borrower for the most extraordinary requests of banks.

Thus, in Russia there are a huge number of mortgage brokers. When choosing who to collaborate with, the main thing is not to get to scammers.

The main feature that distinguishes them from bona fide assistants is demand for commission before anything is done.

6. Frequently Asked Questions (FAQ)

Making a mortgage is not an easy task. It becomes even more complicated if there are no funds for making a down payment.

Naturally, this process raises a huge number of questions. We will try to give answers to the most popular of them further.

Question 1. Is it possible to take a mortgage without down payment and pledge of property?

For a bank to agree to a mortgage, one of the following conditions must be met:

- availability of a reliable guarantor;

- there is a right to state subsidies;

- the presence of valuable property with a sufficiently high level of liquidity.

Only in these cases is it possible to find programs that provide for a lack of down payment.

Some applicants for a mortgage naively believe that to obtain approval for the application, a guarantee of the acquired housing is sufficient. But this is fundamentally not true.

Encumbrance to the apartment is a prerequisite for mortgage lending and cannot cancel the need to make an initial payment. It turns out that the pledge is drawn up without fail.

Question 2. Is it possible to get a mortgage from the developer without having a down payment?

Developers are struggling for every customer.

To speed up sales of apartments in new homes (new buildings) construction companies often conclude agreements with banking organizationsthat offer various unique programs to attract borrowers. In addition, in some cases, a loan can be obtained directly from the developer.

In the first case, mortgages are made through the bank. At the same time, a number of advantages can be distinguished in comparison with the situation when there are no agreements with the developer.

We list them:

- more loyal credit conditions;

- most often, the developer’s employees consult, help to collect a package of documents, which they themselves pass to the bank;

- expedited application review;

- higher probability of a positive decision.

A feature of the second option is that you don’t have to go to the bank. The loan agreement will be concluded directly with the construction company.

In this embodiment, there are significant advantages:

- no need to submit income documents;

- failure is unlikely;

- no need to take out insurance.

But there is a significant minus - the term of the contract usually does not exceed 1 of the year. In very rare cases, developers agree to issue it on 2-3 of the year.

It turns out that this option is a regular installments.

Read about how to buy an apartment in a new building from the developer in one of our articles.

Question 3. Is it worth taking a mortgage on secondary housing with a zero contribution and is there any benefit?

Many who dream of acquiring their own housing do not have money to make a down payment. In these conditions mortgage without down payments may be the only solution. But it’s best to try to find the opportunity to make at least some amount as a down payment.

The fact is that with its complete absence, the rate is traditionally higher minimum 3%. Given the long terms and amounts of a mortgage loan, the overpayment can be huge.

The amount of the loan upon making the first installment will be substantially smaller. This leads to a reduction not only in overpayment, but also in the size of the monthly payment.

Anyway experts recommend thoroughly analyze all possible programs.

Often, after making simple calculations, future borrowers decide on their own to abandon the mortgage without a down payment. Instead, they set aside funds for several years until they accumulate amount of the initial payment.

To calculate mortgage payments, use the calculator:

If there is no way to wait for the moment when funds for the first installment will be accumulated, you will still have to use programs with its absence.

7. Conclusion + video on the topic 📹

For many, a mortgage without a down payment becomes the only way to live in their own apartment. It can be difficult to issue it, especially in cases where there is no right to help from the state.

However, nothing is impossible. The main thing is not to give up and carefully analyze all the offers on the market.

In conclusion, we recommend watching a video on the topic of mortgages without a down payment:

The team of the online magazine "Rich Pro" wishes its readers to get the most profitable mortgage loan and hopes that they can repay it quickly and without problems.

If you still have questions about this topic, then ask them in the comments below. We will also be grateful if you rate our article and share it on social networks with your friends. See you soon!